For far too long, the global luxury ecosystem has been based on a single, antiquated premise: European aesthetic authority supported by passive, often exploitative global sourcing. We are witnessing the deliberate, skilled re-routing of international funds, a Strategic Capital Reallocation, that is redefining who controls the purse strings, the power, and the ultimate source of luxury value.

This movement is propelled by two major forces: the hunt for genuine scarcity in an oversaturated market and the growth of Afropolitan Investment Leadership. Savvy global capital, represented by firms such as Birimian Ventures, no longer sees African design as a CSR project or a trend to capitalise on. It considers it an institutional-grade asset class.

These investors are directly addressing the historical funding barriers for these brands, recognising that the value proposition of culturally rooted luxury, which is scarcity, high durability, and an inherent link to artisanal sovereignty, commands an entirely new premium.

Strategic capital reallocation is reshaping the global luxury ecosystem. Discover the value proposition driving new investors, and why Afropolitan Investment Leadership is the future of the provenance economy.

Why Scarcity is the New Gold: The Provenance Economy

Cash has traditionally controlled the narrative of global luxury, but the sources of that cash are now increasingly diverse. The most powerful force driving the global luxury ecosystem is the ongoing strategic capital reallocation, which is methodically threatening the dominance of established European companies. This trend is not market volatility; it is a deliberate shift in how value is judged.

- The Problem of Legacy Assets

The historical luxury paradigm, which is based on highly scalable, frequently industrialised production, faces a fundamental problem: scarcity dilution. As these companies grow, the perceived uniqueness and intrinsic value of their products decrease, making them less appealing to a portion of the ultra-high-net-worth market seeking genuine rarity. This phenomenon creates a void, prompting new investors to seek out scarce assets.

- The Value Proposition of Provenance

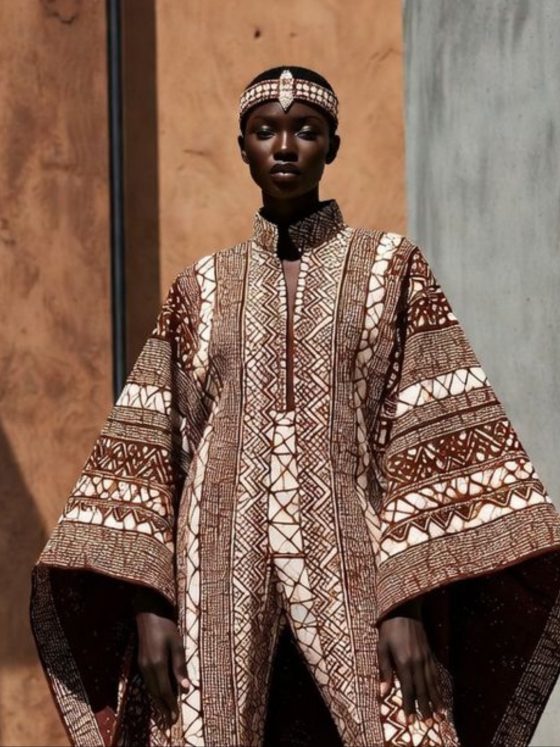

Targeted investment in the provenance economy is addressing this scarcity vacuum. Investment firms are finding culturally rooted brands—from African luxury houses to Diaspora-led ventures- to be an undervalued asset class with a strong value proposition.

- The Rise of Afropolitan Investment Leadership

This financial rationale has given rise to a new type of specialised investment platform, most notably Birimian Venture’s all-female executive team. These companies do more than just provide cash; they also offer institutional-level assistance to brands such as Christie Brown and Loza Maléombho in addressing structural issues in production, internal controls, and worldwide distribution. By investing patient, long-term capital, they are intentionally grooming African creators to become global, institutional-grade brands.

- The investment is strategic

It is a wager on the long-term, inflation-proof value of irreplaceable human expertise above factory speed. This symbolises a clever, worldwide solution to market failure, guaranteeing that the Afropolitan Aesthetic achieves the financial stability essential for global domination.

The Digital Gateway: The Tech & Venture Capital Acquisition Strategy

Historically, infrastructure has been the most significant impediment to the development of the Provenance Economy, notably in the logistics, payment processing, and inventory management required to meet global demand for artisanal sovereignty. Global Fashion Investors are not waiting for this infrastructure to emerge spontaneously; instead, they are actively acquiring and sponsoring technical solutions that will drive the market open.

- The Algorithm of Authenticity

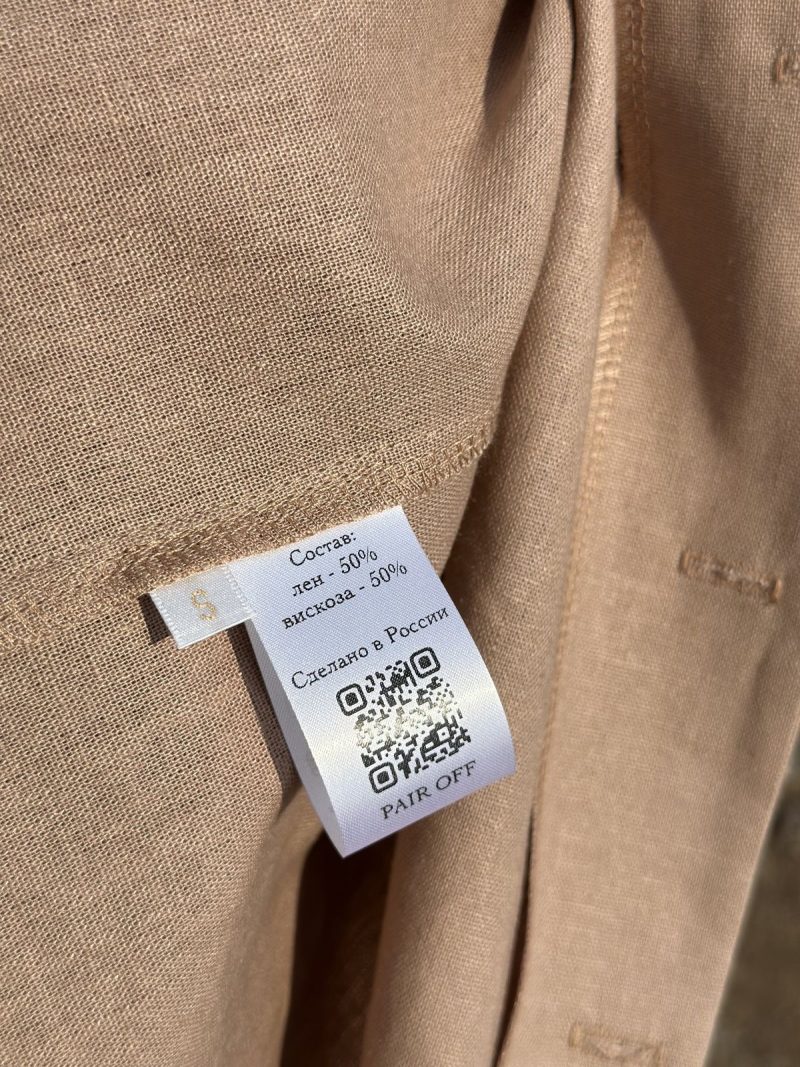

The major job of fresh capital is to address the dual problems of authenticity and traceability. The origin of an Aso-Oke garment or a piece of luxury leather is a key value proposition that counterfeiters have undermined in the legacy system. New investment is flowing into blockchain and AI technologies, positioning them to become the latest digital passport for luxury products. This technology facilitates the creation of an indelible, verifiable record of a product’s journey, from the sourcing of raw materials to the artisans’ hands.

- The $50 Million Digital Leap

The recent launch and funding of Stitches Africa exemplifies this convergence of finance and technology. The company got a $50 million finance package, aimed primarily at globalising African fashion. This capital is not just for marketing; it is reserved for:

- Production financing allows tailors to increase output

- Logistics Infrastructure Development for International Fulfilment.

- AI-powered technology updates for accuracy measurement and B2B ordering.

This significant investment shows that investors believe these tech platforms are essential for connecting high-quality, handmade products to the global luxury market. Controlling the infrastructure allows new investors to influence future trade conditions.

ALSO READ:

The Ownership Revolution: ESG as the New Investment Mandate

ESG (Environmental, Social, and Governance) is no longer a passive kind of corporate social responsibility; it is the non-negotiable investment mandate that drives Strategic Capital Reallocation. Institutional investors, who manage trillions of dollars, now evaluate a company’s long-term success based on how well it can protect itself from risks related to climate change, ethics, and governance. This institutional desire for low-risk, high-integrity assets has created the ideal conditions for the Provenance Economy to develop.

Financial Superiority of Sustainability

This investment rationale structurally favours culturally rooted brands whose production practices are intrinsically ethical.

- Vertical Integration and Traceability:

Acquisition strategies increasingly prioritise control over the entire supply chain. Because of the nature of artisanal sovereignty, African luxury houses frequently maintain direct, verifiable links with local suppliers, ranging from small-scale cotton farmers to local leather tanners. This openness eliminates supply chain opacity and significant ESG risks associated with fragmented global production.

- Built-in Circularity:

African-rooted brands are inherently circular. Practices such as using durable, generational textiles (such as Kente, which are heirloom items) or traditional, low-impact dyeing methods (such as Bogolan) provide an instant, verifiable ESG credential that legacy brands struggle to manufacture and frequently rely on greenwashing to achieve.

- Inclusivity:

The ‘S’ Factor in Investment Leadership. Afropolitan Investment Leadership’s most significant competitive advantage is in the “S” (Social) component of ESG. Institutional capital specifically rewards initiatives that promote diversity and community upliftment.

Conclusion

We are seeing a profound adjustment. The global luxury ecosystem is shifting from a model of mass-produced ambition to one based on verifiable provenance and artisanal sovereignty. The new generation of Global Fashion Investors, led by intelligent Afropolitan Investment Leadership, is providing the capital and technological infrastructure needed to increase absolute uniqueness. By focusing on environmental, social, and governance issues, along with traceability and real value, Strategic Capital Reallocation is investing in and backing these efforts. As a result, the financial and creative centres of gravity are shifting towards those who have actual value.

Read our definitive report on how strategic capital reallocation and the rise of Afropolitan investment leadership are dictating the future of the global luxury ecosystem exclusively on Omiren Styles.

FAQs:

- What is meant by ‘strategic capital reallocation’ in luxury markets?

A: Strategic capital reallocation is the deliberate, calculated movement of significant institutional funds (from VCs, private equity, and major funds) away from the slow-growing, industrially scaled legacy luxury brands and into high-growth, culturally rooted segments that demonstrate superior long-term scarcity and ESG compliance.

- How do African brands offer better ESG (sustainability) value to investors?

A: African brands often offer better ESG value through inherently sustainable practices: using durable, generational textiles; employing low-impact natural dyeing; and operating with highly traceable, usually vertically integrated supply chains that secure artisanal sovereignty and offer fair community engagement. This approach reduces the risk of future regulatory and climate-related issues for investment portfolios.

- Why is ‘Afropolitan Investment Leadership’ driving this financial shift?

A: This leadership, often represented by firms founded by experienced professionals from the Diaspora or the Continent, brings two crucial assets: unparalleled cultural knowledge to identify authentic, undervalued Provenance Economy assets and the institutional expertise required to structure these brands for global M&A and investment standards.

- What role does technology play in making these brands ‘institutional grade’?

A: Technology (VC-funded AI and blockchain) closes the historical gap in infrastructure. It provides digital passports for authentication and traceability, standardises bespoke measurements for scaling, and consolidates fragmented logistics, thereby providing the data and security required for large-scale institutional investment.

- What is the distinction between ‘Provenance Economy’ and ‘Legacy Luxury’?

A: Legacy Luxury is defined by brand name and is reliant on industrial scale (high production, low scarcity). Artisanal sovereignty and verifiable origin define the provenance economy; its value is rooted in scarcity, generational durability, and the non-replicable human skill invested in its creation.