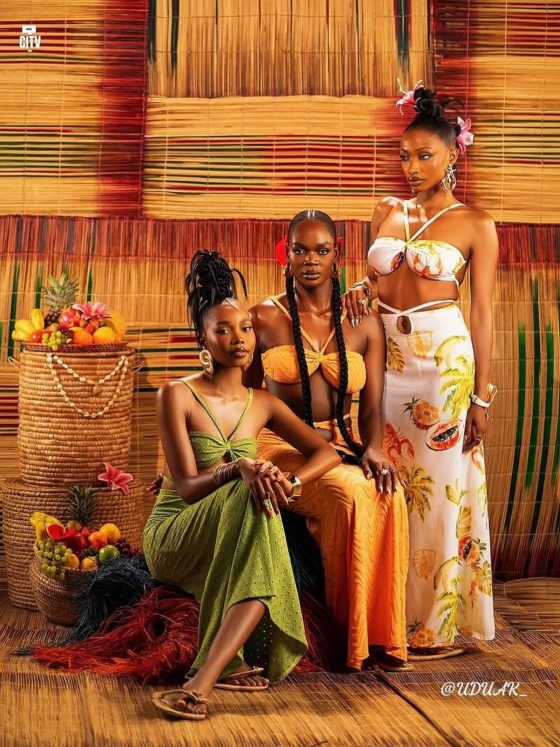

Representation in fashion and beauty has long been framed as a social imperative. In 2026, representation in fashion and beauty will also become an economic imperative. Across Africa, consumer demand is shifting toward products that reflect lived realities, skin tones, body types, climates, and cultural expression. Traditional mass-market formulas, heavily influenced by Western standards, excluded large segments of African consumers. This exclusion is now measurable: brands that actively embed representation into product development are capturing incremental revenue, building loyalty, and creating categories previously underserved.

Inclusive design, including solutions for diverse skin conditions such as albinism, is not simply about ethics. It is a commercial lever that transforms innovation pipelines, distribution strategies, and consumer engagement, establishing a multi-billion-dollar growth opportunity for African brands.

Inclusive African fashion and beauty are driving growth, with culturally aligned products unlocking new markets and sustainable revenue streams.

The Market Logic Behind Representation

Historically, African consumers were treated as a niche, with products designed for global averages rather than African realities. Shade ranges, body-fit options, and skincare formulations often ignore climate, skin biology, or cultural preferences; the result is structural inefficiency, low adoption, high returns, and disengaged consumers.

As awareness grows through social media, e-commerce platforms, and localised retail advisories, consumers signal their unmet needs more clearly. Industry reporting now attributes roughly 22% of incremental category growth in fashion and beauty to cultural and physiological alignment. Scale in 2026 is less about broad mass appeal and more about depth, specificity, and responsiveness in designing products that genuinely fit African consumers.

Inclusive Skincare and the Albinism Gap

Albinism highlights the intersection of representation and innovation. Individuals with albinism have increased vulnerability to UV radiation, making standard sunscreens and cosmetics ineffective or unsafe. Historically, products assumed uniform melanocyte biology, creating a gap in both safety and commercial opportunity.

African-focused initiatives are beginning to address this gap:

- Under the Same Sun (Tanzania) partners with local skincare suppliers to provide sun protection and educational programmes for people with albinism.

- Skin Gourmet (Ghana) creates easy-to-follow, plant-based products that work well for different skin issues, including those

This is a clear economic signal: serving previously excluded physiology drives product innovation, which benefits broader skin categories as well. Early entrants into these niches gain a competitive advantage and first-mover share in underserved markets.

African Brand Case Studies Driving Representation

House of Tara (Nigeria)

- Pioneered foundation and concealer ranges specifically for African skin tones.

- Developed training programmes for makeup artists, creating local expertise.

- Expanded regionally across West Africa, translating shade accuracy into revenue growth.

Insight: Representation at the product and knowledge level expands both direct sales and ecosystem influence.

Zaron Cosmetics (Nigeria)

- Formulated for tropical climates: high humidity, heat, and melanin-rich skin.

- Focused on reliability and consistency, improving repeat purchase rates.

Insight: Products designed for local conditions outperform imported generalist formulations.

R&R Luxury (Nigeria/Ghana)

- Leverages indigenous oils, shea butter, and moringa for skin formulations.

- Integrates local sourcing, supporting supply-side inclusion and community economic participation.

Insight: Inclusive sourcing strengthens supply chains and embeds African ingredients in global narratives.

Nokware Skincare (Ghana)

- Earth-based skincare developed for African phototypes.

- Traceable, natural ingredients signal quality while creating a competitive market distinction.

Insight: Inclusion drives premium perception; culturally aligned products can command higher margins.

Suave Clothing (Ghana)

- Produces apparel aligned with real African body types and sizing diversity.

- Avoids European-fit assumptions, improving both adoption and brand loyalty.

Insight: Physical representation, beyond skin tone, is equally critical to market capture.

READ ALSO:

- Inside the Hidden Commercial Systems Behind Successful Fashion Houses

- What Growth Means for a Fashion Brand: Profit, Scale, or Presence?

The Cost of Exclusion in a Growing Market

Ignoring representation is increasingly expensive. Brands that fail to reflect African consumers in product design or marketing face:

- High return rates from a mismatch of shade, fit, or climate suitability

- Shelf invisibility in retail spaces dominated by culturally aligned competitors

- Consumer migration to challenger brands that meet their expectations

African-founded labels illustrate the economic upside of proactive inclusion: design decisions aligned with consumer reality translate directly into measurable growth, not just aspirational goodwill.

Why Inclusion Becomes a Growth Strategy Rather than Advocacy

Representation reshapes innovation and market positioning:

- Product pipelines: Inclusive R&D improves efficacy and broadens applicability.

- Consumer intelligence: Engagement with diverse users generates actionable data on skin, fit, and preference patterns.

- Market expansion: Tailored products create regional and international opportunities, as formulations and designs are transferable across similar climates and phototypes.

Inclusivity is no longer a compliance or PR tactic. It is a repeatable, measurable business advantage that influences both short-term revenue and long-term category leadership.

Conclusion

In 2026, representation in African fashion and beauty is a multi-billion-dollar strategy. African brands that reflect the continent’s diversity in skin tones, body types, heritage, and climate need to capture disproportionate growth while unlocking new product categories and exportable expertise. Inclusive skincare, apparel, and cosmetic products demonstrate that ethical representation and economic efficiency are aligned. Companies that operationalise inclusion strategically will outpace legacy, generic models in both revenue and market relevance.

Representation is not charity. It is strategy and African brands built around authentic inclusion that are defining the continent’s commercial future.

FAQs

- Why is inclusive African beauty a growth driver?

It unlocks spending from previously underserved consumers and converts unmet needs into revenue.

- How does albinism shape product innovation?

It creates demand for sun-safe, pigment-aware formulations that also benefit broader skin categories.

- Which African brands show success with inclusion?

House of Tara, Zaron Cosmetics, R&R Luxury, Nokware Skincare, and Suave Clothing demonstrate measurable growth through inclusive design.

- What happens if brands ignore representation?

They risk losing sales, weak brand loyalty, and market share migration to inclusion-focused challengers.

- Is representation ethical, commercial, or both?

It aligns brand values with revenue growth while meeting the needs of real consumers.