Successful fashion houses rarely succeed because they are creative. Creativity attracts attention, but commercial systems keep a brand alive.

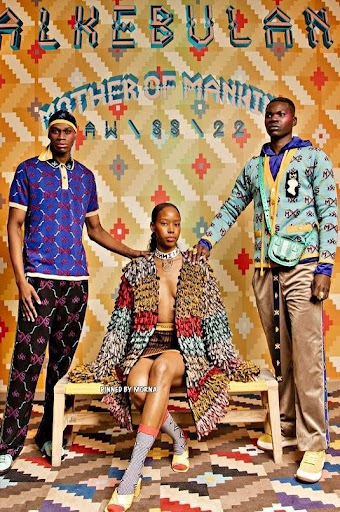

For this research, we examined eight global fashion houses founded by African designers whose work has crossed borders, won institutional recognition, entered global retail pipelines, or achieved decade-long relevance:

Thebe Magugu, Maxhosa Africa, Lisa Folawiyo, Maki Oh, Studio One Eighty Nine, Ozwald Boateng, Kenneth Ize, and Iamisigo.

Each brand has a distinct identity. Yet beneath the surface, their growth paths reveal shared structural decisions about supply chains, margins, capital, and workflow that separate longevity from collapse.

Discover the hidden commercial systems behind global fashion houses. This article provides an in-depth look at how these brands maintain profitability through their supply chains and financing models.

Supply Chains Built for Control

Every brand in this study solved production before pursuing scale.

Thebe Magugu

- Before opening a retail space, Thebe Magugu ran collections through tightly controlled small-batch networks in Johannesburg (Magugu House, 2024).

- Outsourcing stayed local until quality consistency was fully established.

- Expansion only shifted after LVMH improved factory access.

Maxhosa Africa

- Maxhosa Africa established its brand in the knitwear category, which demands precision in manufacturing.

- Early years involved commissioning South African knit factories willing to translate Xhosa patterns accurately, a strategic constraint that protected brand identity.

Lisa Folawiyo

- Lisa Folawiyo established private tailoring studios specifically for garments with intricate embellishments.

- Controlled export quality by keeping complex hand-finishing in-house.

Studio One Eighty Nine

- Hybrid model: Ghana-based artisanal production + US retail and distribution.

- Partnerships with the UN’s Ethical Fashion Initiative embed brands in specialist supply chains skilled in dyeing, weaving, and slow-fashion textiles.

Ozwald Boateng

- Ozwald Boateng established his business on Savile Row, the globally renowned tailoring supply chain.

- Quality consistency came from mastering existing systems rather than building new ones from scratch.

Kenneth Ize

- We reintroduced Aso-Oke weaving by institutionalising artisans’ capacity and modernising the finishing process.

- Paris Fashion Week participation required adapting heritage craft to industrial expectations.

Iamisigo

- Iamisigo operates across Nigeria, Ghana, and the DR Congo, decentralising production to access specialised artisanal skills while intentionally maintaining small batch volumes.

Insight:

In all cases, supply chain choices favoured precision over volume, skill over convenience, and reliability over speed. This contradicts the fast-fashion model and aligns with luxury fundamentals.

Margin Logic Before Marketing

Margins, not revenue or visibility, kept these houses alive.

From the research, three dominant pricing models appear:

A. High-margin, Low-Volume

(Deola-era couture logic applied by modern brands like Lisa Folawiyo and Maki Oh)

- Requires brand equity

- Limits operational risk

- Generates cash per unit instead of money per order

B. Cultural Luxury With Substantial Story Value

(Maxhosa, Kenneth Ize)

- Cultural narrative increases perceived value

- Allows brands to charge far above local-market affordability

- Protects margin integrity in export markets

C. Social-Enterprise-Luxury Hybrid

(Studio One Eighty Nine)

- Artisanal work = premium-only pricing

- Value proposition includes ethics and community impact.

Margin Lesson From Boateng

Boateng’s Savile Row positioning insulated his pricing from trend volatility; his value is expertise.

Luxury tailoring margins are protected by time, scarcity, and mastery.

Observation:

No successful house in this sample led with discounting, volume chasing, or underpricing, the three behaviours most linked to brand death.

READ ALSO:

Financing Models: Slow Capital > Fast Capital

None of these brands scaled using aggressive debt or venture money.

Their financing paths fall into four documented types:

1. Awards & Institutional Capital

- Thebe Magugu: LVMH Prize (EUR €300,000 + mentorship)

- Kenneth Ize: Karl Lagerfeld Prize finalist

Impact: Mentorship redirected operations toward sustainability before scaling.

2. Social and Development Funding

- Studio One Eighty Nine: UN Ethical Fashion Initiative

Impact: Accessed structured supply lines + international retail pipelines.

3. Self-Funding + Revenue Recycling

- Lisa Folawiyo, Maxhosa Africa: Reinvested sales into expansion

Impact: Grew only at the pace cash flow allowed, protecting solvency.

4. Legacy Craft Infrastructure

- Ozwald Boateng: Leaned into the established ecosystem of Savile Row—impact: The brand scaled inside a mature commercial system rather than building one from scratch.

The system that wins is patient capital, with emphasis on mentorship, ecosystem access, and incremental reinvestment.

The workflow initially starts as founder-centric and transitions to systems-led over time.

A pattern emerges:

Early phase:

The early phase involves a designer-led decision-making process, a small team, and direct oversight of product quality.

Growth phase:

Introduction of:

- Studio managers

- Production heads

- Patternmakers

- Retail or buyer relations staff

- Communications directors

Case signals:

- Magugu’s physical retail store launch indicates operational decentralisation.

- Studio 189’s dual-country HQ model demonstrates workflow maturity.

- Boateng’s Savile Row store required professional management beyond tailoring.

Insight:

Brands that stay permanently founder-operated without building teams eventually cap their growth.

Documented Milestones Signalling Commercial Maturity

Across the eight brands, common markers show when “craft becomes business”:

- Winning global institutional awards (Magugu, Ize)

- Opening flagship stores (Magugu House; Boateng Savile Row)

- Regular international fashion week showing

- Partnerships bridging markets (Studio 189 with UN; Ize with European ateliers)

- Celebrity adoption (Maxhosa: Beyoncé; Lisa Folawiyo: Solange)

- Cross-border retail placement

- Growth into product extensions (Boateng fragrances)

These milestones reflect commercial transition points, not just creative achievement.

Lessons Emerging Brands Can Apply

From all eight case studies, three business laws recur:

- Protect margins early; pricing is your strongest shield

- Build capacity slowly; quality collapse is expensive to repair

- Delay visibility until operational systems can absorb demand

These are the behaviours that spell the difference between a three-year hype cycle and a 30-year fashion career.

Conclusion

African-led fashion is often discussed through creativity or culture.

But the brands that break into and stay in the global market do so by building strong commercial systems first:

- Supply chains designed for excellence

- We protect margin logic at all costs.

- Patient financing over fast money

- Workflows that evolve with scale

These houses show that success is not magic, luck, or social media moments but strategy, timing, and disciplined operational choices.

FAQs

- How do successful fashion houses structure their supply chains?

Top fashion houses build intentional supply chains that rely on in-house production, artisan partnerships, or controlled factory networks to maintain quality, consistency, and identity.

- What financing models help emerging fashion brands grow sustainably?

Award funding, ethical partnerships, reinvested revenue, and ecosystem support have proven more reliable than debt or venture capital for the longevity of fashion brands.

- Why are margins more critical than visibility for fashion businesses?

High margins allow brands to survive slower months, maintain quality, and grow sustainably, while visibility without margin control often leads to brand collapse.

- How do fashion designers transition from creative founders to business operators?

Successful founders gradually delegate production, retail, and communication roles, shifting workflow from a single creator to a professionally managed studio.

- Which African fashion houses demonstrate strong commercial systems?

Brands like Thebe Magugu, Maxhosa Africa, Lisa Folawiyo, Studio One Eighty Nine, Kenneth Ize, and Ozwald Boateng showcase sustainable growth built on structure.